Commitment that pays off in financing: This is the idea behind the new factoring agreement that Leadec has concluded with SüdFactoring in Germany. The ESG component (environmental, social, governance) has been added to what was previously a classic factoring contract. This means that as soon as Leadec improves its standard, the cost of financing falls – and vice versa.

Christian Geissler, CFO at Leadec

“We operate in more than 300 locations worldwide and make a positive contribution locally through our sustainability strategy. With ESG-linked factoring, we are now bringing financing and sustainability together.”

Independent assessment

But who decides whether the company is improving, deteriorating or stagnating? For this, the financial services provider draws on the assessment of EcoVadis, an independent rating agency that has awarded Leadec the bronze level. For the four ESG standards Platinum, Gold, Silver or Bronze, 21 criteria from the areas of environment, labor and human rights, ethics and sustainable procurement are assessed and taken into account each year.

A building block of the strategy

Sustainability at Leadec is thought of holistically. In addition to services such as digital tracking of waste in the factory or smart maintenance in the food industry, we also pursue our own environmental goals and are active in networks, such as the UN Global Compact. ESG-based factoring in Germany now adds another aspect.

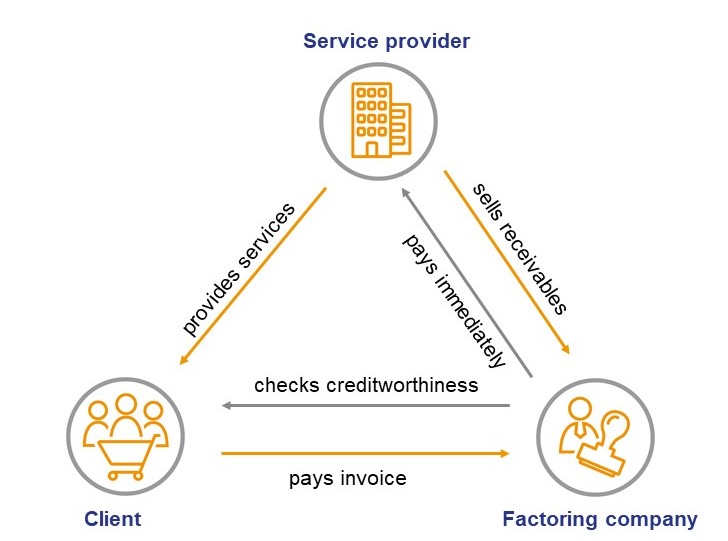

What is “factoring?”

Factoring, i.e., the sale of accounts receivable to third parties, is a classic instrument for keeping companies’ liquidity predictable and avoiding default risks. The factor is interposed between the service provider and the service recipient, settles a large part of the receivable as a direct lender, and then collects the receivable from the service recipient before paying the remainder.